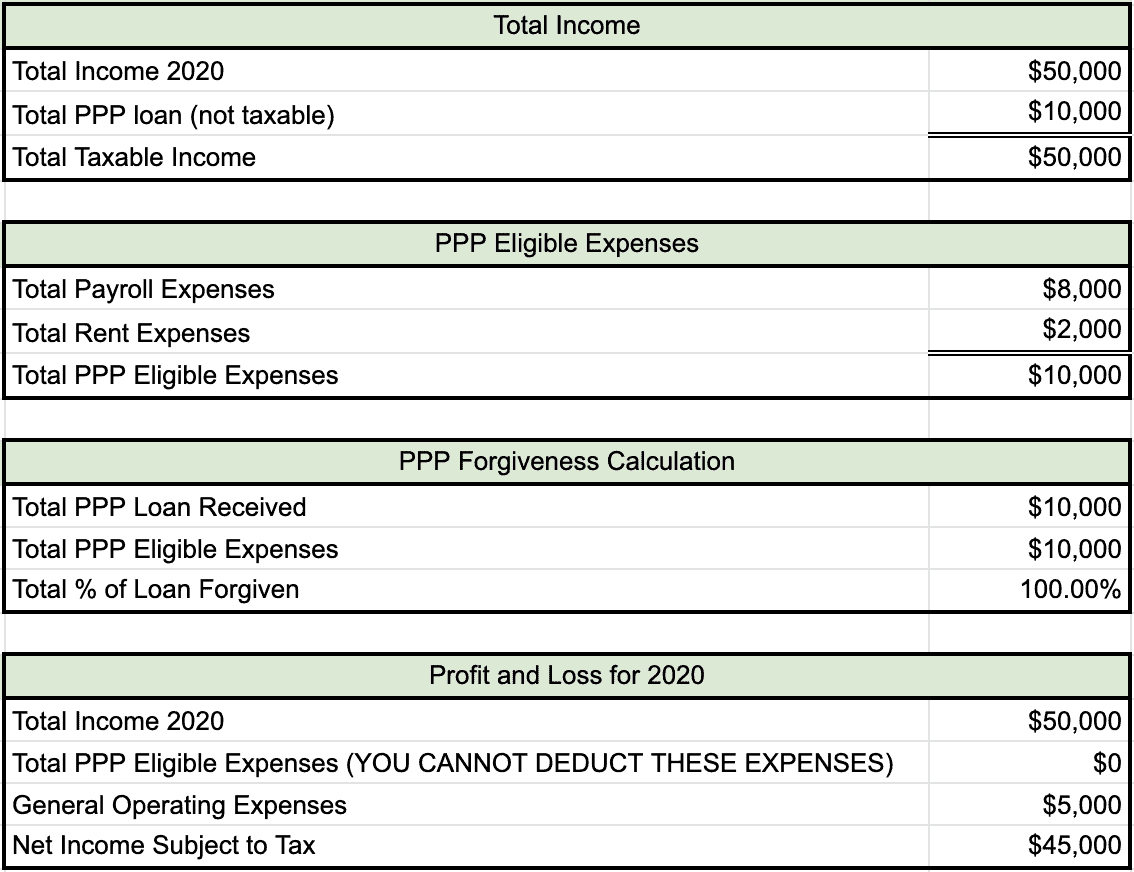

Confused by this spreadsheet? Keep reading.

It was only a matter of time before the IRS came forward with guidelines for the PPP and taxes.

On Thursday of last week, the IRS issued Notice 2020-32, which presents new challenges for business owners as they move forward with their PPP funds. Here’s what it means for you and your business:

For starters, let’s clarify three things:

1) PPP loan amounts that are forgiven are not taxable income.

2) PPP loans are approved to cover a majority of payroll expenses, mortgage interest, rent, + utilities.

3) If you use at least 75% of your loan to cover payroll, and the rest to cover the aforementioned expenses, you’ll be eligible for 100% loan forgiveness.

So what does this mean for your business?

Simply put, the notice states that business owners may not deduct expenses paid for by their PPP loan when submitting 2020 tax returns.

The idea behind this notice from the IRS is that, if a business receives a $10,000 loan to use for payroll and other business expenses (a loan they won’t need to pay taxes on + *hopefully* will end up being almost or totally forgiven), they should not then request a “double benefit” by attempting to get tax deductions on expenses paid for by said PPP loan.

Using the example above to illustrate this point:

If you receive a $10,000 PPP loan and you use it to cover $8,000 of payroll expenses and $2,000 of rent expenses, these expenses (the rent and payroll), which might normally be tax-deductible, are no longer eligible for deduction.

HOWEVER, that doesn’t mean that if you spent additional money during the year on payroll and rent, that you won’t be able to deduct that amount.

You will need to subtract the amount the PPP did cover, so as not to risk tax penalties.

The government will look at it like this: “We gave you extra money this year to keep your business afloat. We won’t tax you on this money. It’s a gift. We’re the best; you’re welcome. Btw, great job getting it forgiven — but don’t then come to us and try and get money back on business expenses you used our gift to pay for. We already gave you money for that — don’t be greedy!”

THAT is why it’s called a “double benefit” i.e. double-dipping.

In light of this and other details I have learned about the PPP, I am recommending that all businesses open a separate bank account to avoid a complicated audit process by the IRS and/or risking your loans not being forgiven.

I am also strongly recommending you stay on top of your bookkeeping. Trust me when say, I GUARANTEE that it will save you down the line. Sign up for a free consultation.