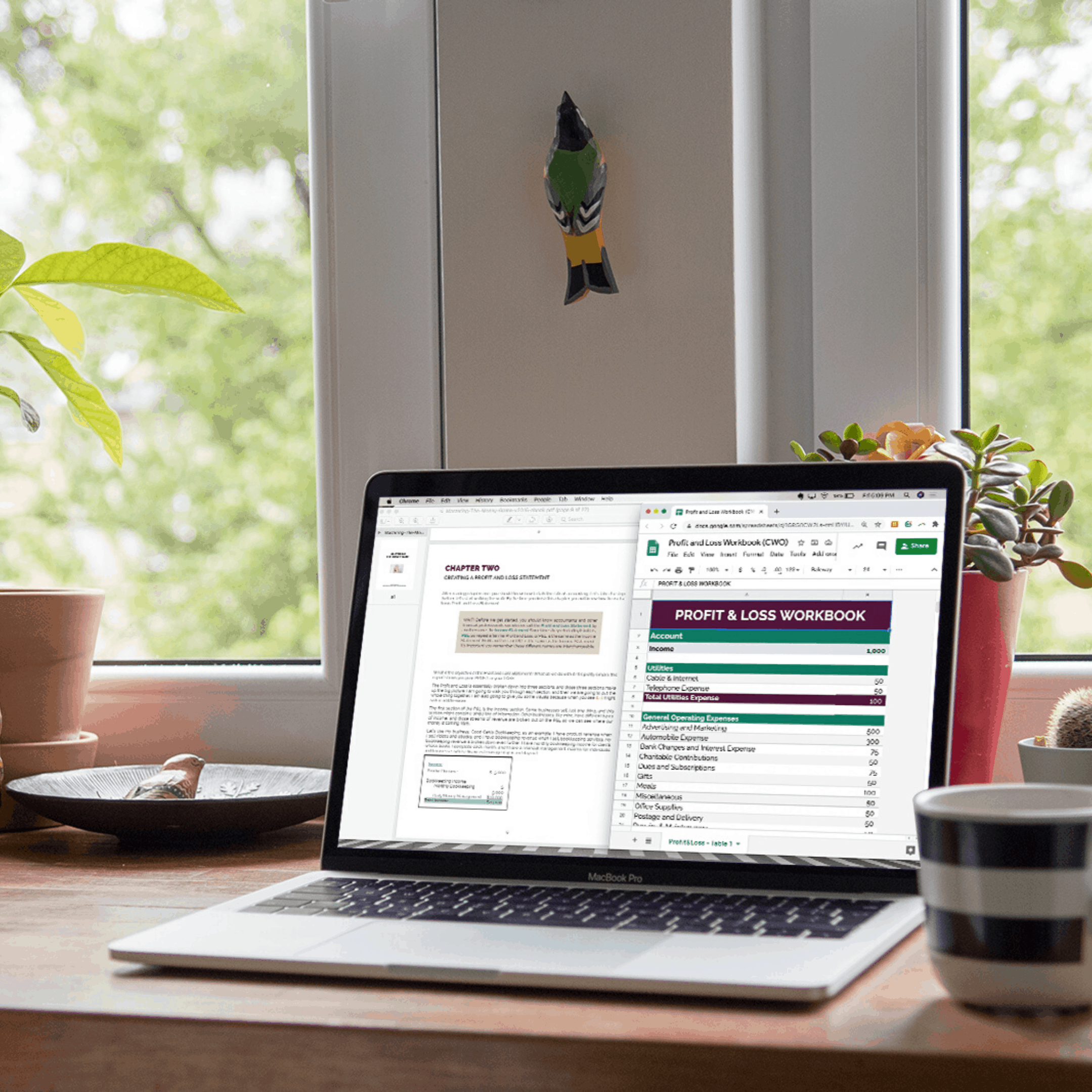

Download your FREE Profit and Loss Template and Guide here.

It’s important to note that accountants and other financial professionals sometimes call the Profit and Loss Statement the ‘Income Statement’. Sometimes they refer to it by its initials: P&L.

The Profit and Loss, or P&L, is the same as the Income Statement; these different names are interchangeable.

The Profit and Loss Statement summarizes the expenses, revenue, and overall profit for a business during a fixed period of time (such as a month, quarter, or year). An accurate P&L will tell if you made a PROFIT or had a LOSS.

The Profit and Loss is essentially broken down into three sections, and those three sections make up the big picture:

1. INCOME

Here you’ll calculate your gross sales (all the money you made before you subtract any expenses). Some businesses just sell one thing, so this section might contain a single line of information. Other businesses have different types of income, and those streams of revenue are broken down on the P&L so you can see where your money is coming from.

For example, if a business sells only software their P&L Income section would look like this:

Software Sales: $1,000

If we use Good Cents as an example, we have a few different revenue streams:

Bookkeeping Services: $1,000

Consulting Services: $1,000

Digital Course Sales: $500

TOTAL SALES $2,500

2. Cost of Goods Sold, or Cost of Sales

If you’re selling goods (physical items), this section is called the Cost of Goods Sold. If you are selling services, this section is called Cost of Sales. Whether you have Cost of Goods Sold or Cost of Sales, this section will reflect all of the money you spend – both in materials and direct labor – to sell your products or services.

For example, if it costs you $10 dollars to manufacture a t-shirt, including thread, fabric, and labor, your “COGS” is $10.

If you have a graphic design agency, and you paid freelance graphic designers $1,000 during the year, your Cost of Sales is $1,000.

Knowing the accurate cost of goods sold or cost of sales is CRITICAL because it determines your gross margin number. You always want your gross margin to be as high as possible.

You determine the gross margin by subtracting Cost of Goods Sold from Gross Sales and then dividing that number by your Gross Sales:

3. Calculating Expenses

The final section of the P+L involves calculating your expenses.

The expenses section covers all of the other money you spend to run your business. It includes things like:

- Advertising

- Rent

- Software subscription fees (this one is tricky; if it’s a software you use to directly service your client, it might be COS)

- Professional fees like accounting, bookkeeping and legal

- Utilities including phone and internet access fees

- Travel

A good way to think about this in your head is:

– If you spent money on general operations, it’s an EXPENSE.

– If you spent money, whether on labor that you resold to clients (if you are service-based business) or on manufacturing (if you are a product-based business), it is a COGS or COS.

As your business grows, you’ll start analyzing your Gross Margins not just by the total Income divided by total Costs of Sales, but by product and by customer. This will help you figure out what services and items you are selling that are making you the most money.

It’ll help you decide if it’s worth it to keep working with a client that might be a profitability pitfall. You’ll also start figuring out a portion of your overhead costs as a portion of your Cost of Good Sold, such as the percentage of rent you spend for inventory warehousing.

Download my free P+L Template and Guide to input your business’ sales, costs of goods/sales, and expenses to gain a deeper and essential understanding of your numbers.